India has seen a revolutionary growth of FinTech companies over the last few years. The stringent and traditional financial ecosystem worked as a catalyst for the FinTech boom. The country is home to a whopping 6000+ FinTech companies, while the industry is valued at $30 Bn, as per a PwC report.

The growth story of FinTech companies in India is closely aligned with the rise of the startup ecosystem. Financial technology empowered new business owners and entrepreneurs to manage and scale their operations with confidence. Several small and medium-sized businesses have been leveraging advanced tech platforms and solutions to improve their operations.In this article, we will discuss the impact of FinTech companies in democratizing financial services and products to empower businesses, along with exploring the simplification of the approval process for better efficiency.

FinTech companies in India have opened up access to technology to every organization, small and large. It enabled businesses to enhance their operations through automation, and analytics. Organizations have transformed their workflows within finance and accounting departments simplifying day-to-day financial operations like expense tracking, and invoice management. While these tasks were done manually which demanded a lot of time and effort, they were riddled with mistakes and human errors. It has all changed now with AI-driven workflows. Some of the areas where FinTech companies made significant contributions are:

- Access to Credit: FinTech companies allow organizations to utilize innovative financing options like peer-to-peer lending and revenue-based financing.

- Data-driven Decisions: Businesses today have solutions that collect, analyze, and report insights so that companies can easily identify potential problems early on and make informed decisions to mitigate risks.

- Ensure Compliance: FinTech companies ensure that businesses comply with industry standards and regulations, by making operations easy to manage.

Besides these three core areas, FinTech companies in India have made a major mark in how organizations handle approval processes. Let’s discuss how.

Approval Process – How FinTech Companies Make it Efficient

In any organization, a majority of tasks undertaken by accounting and finances hinge on stakeholder buy-ins and approvals. Be it expense claims, invoice settlements, or other business transactions, finance leaders must wait on concerned managers to close a task. The obvious delay at this stage can disrupt operations by upsetting employees waiting on refunds and impacting the supply chain with vendors withholding services on payment default. It further causes non-compliance and can attract serious penalties. These critical challenges in managing approval processes manually can be eliminated through an automation solution by FinTech companies. Below are some of the ways automation helps improve approval workflows.

Streamlining workflows

You can create automated workflows to route every request across departments through the appropriate approver based on pre-defined rules. With this, the accounts team will be free from chasing around the stakeholders to get approvals manually, and instead focus on other critical tasks.

Automating approvals

In any company, there will be recurring bills or invoices that can be discounted from manager approval. Instead, you can configure automated approvals by determining rules based on vendor, bill amount, and spend category. Therefore, whenever an approval request is raised matching the criteria, it will be approved automatically.

Reducing human errors

The manual approval process involves creating paperwork, which means entering the data from source documents into company templates. This opens up risk factors since data entry errors are the most common roadblocks in manual approvals. You can also digitize paper-based invoices or bills using technologies like OCR (Optical Character Recognition). This will not only eliminate errors and rework but also document every approval request.

Improving visibility

By automating your approval processes, you will have better visibility into the status. It allows users to track the approval process in real-time allowing finance and accounts teams to give realistic timelines of payments. It will help them manage the expectations of employees or vendors with ease.

Enhancing compliance

Automation tools come equipped with features like alerts and reminders so that you can avoid delays in getting payments approved. You can further automate reminders to be triggered after an acceptable period of delay, while also tagging the urgency of the approval. It will help companies avoid penalties and compliance issues.

Unravel your approval process with Zaggle

Delays in clearing payments for invoices or expense claims have always been a major issue for businesses. However, with FinTech companies automating the end-to-end process, businesses of all sizes can now run their businesses without disruptions due to invoice clearance delays.

As discussed earlier, India is home to thousands of FinTech companies. It means the market is riddled with automation products. To ensure you maximize the use of technology, choose a solution that best suits your requirements.

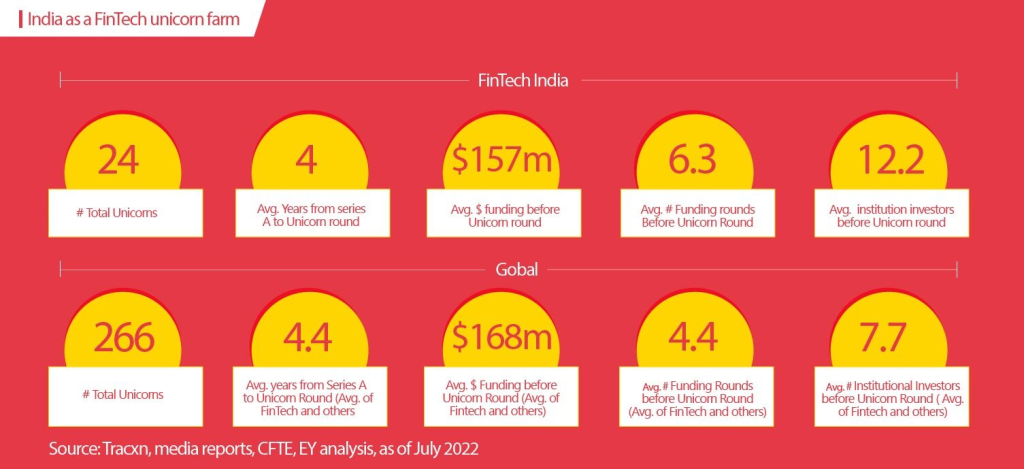

Zaggle, one of the few FinTech unicorns in India, has designed a unique portfolio of FinTech solutions to address challenges within every aspect of finance management.

- Zaggle Zoyer: Spend management and embedded finance platform

- Zaggle Save: Employee benefits solution

- Zaggle Propel: Employee and channel partner incentive management software

- Zaggle ZatiX: Integrated credit cards and spend analytics platform

Talk to our experts to see how Zaggle can help your business expand internationally.

Login/Sign Up

Login/Sign Up

Redeem Zaggle Propel Card

Redeem Zaggle Propel Card

Manage Zaggle Cards

Manage Zaggle Cards